BHP after-tax profit drops 37pc

The world's biggest miner has seen after-tax profit drop because of accounting losses from the recent US company tax cuts, but it has boosted returns for shareholders.

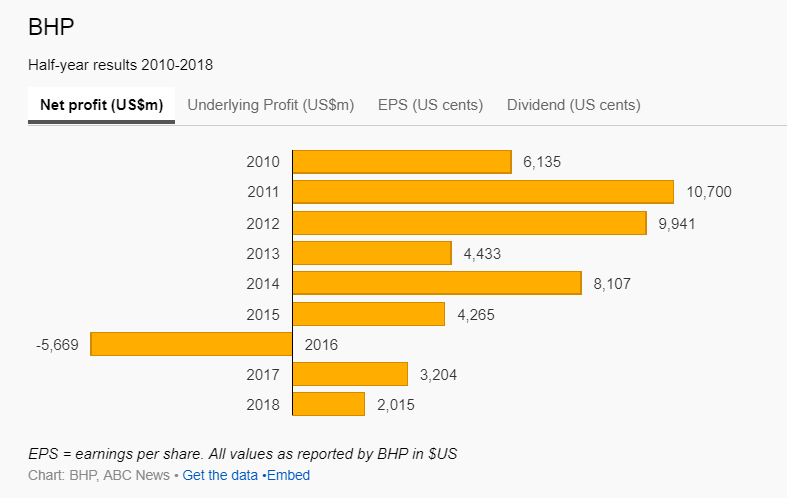

BHP made an after-tax profit of $US2.01 billion ($2.55 billion) for the six months to the end of December.

The figure was down 37 per cent from a $US3.20 billion net profit for the same time in 2016.

BHP's net profit was lowered because it was hit with a one-off income tax charge of US$1.83 billion as a result of the US tax law changes, but it said the US tax cuts will see it pay lower taxes on its US businesses including oil and gas in the future.

It also took a $US210 million loss over the half year because it was paying compensation and clean-up costs for the 2015 Samarco mine disaster in Brazil.

The US corporate tax rate was cut from 35 per cent to 21 per cent after it passed through the US Congress in December.

BHP chief financial officer Peter Beaven said the reduction in US company tax rates would be a big benefit for the company.

"I think it will help enormously in obviously the current profitability, but more importantly for future investment decisions. And obviously it'll help attract additional capital, win that battle for capital inside of our organisation," he told The Business.